ProInvestor Insights: Exclusive Buy Writes from Forbes' John Dobosz

For the upcoming ProInvestor Insights Newsletter, Forbes Magazine Editor John Dobosz has two new Buy Write recommendations to kick off the week. Known for his expertise in income-generating strategies, John brings his deep experience to ProInvestor Insights readers with these fresh insights.

John’s investment background includes heading three major Forbes investment newsletters: Forbes Dividend Investor, Forbes Billionaire Investor, and the covered call writing advisory Forbes Premium Income Report. His career, spanning work at CNN Financial News, Bloomberg TV, and Inc. Magazine, gives him a unique perspective on the markets, helping investors maximize income through buy-write strategies.

For the November 15th issue, he will offer additional Buy Write recommendations that could complement readers' portfolios with promising income opportunities. Stay tuned!

Kennametal Buy Write Grabs Dividend Next Week, Offers 47% Annualized Return Potential

This recommendation is a buy write on shares of Kennametal (KMT), a supplier of tools and machinery for steel cutters and other industrial and infrastructure companies. Kennametal has an ex-dividend date next Tuesday, November 12, for a payout of $0.20 per share. Doing this buy write today puts you in line to grab that dividend.

Please email me (dobosz@gmail.com) at any time with questions, and connect with me on LinkedIn. — J.D.

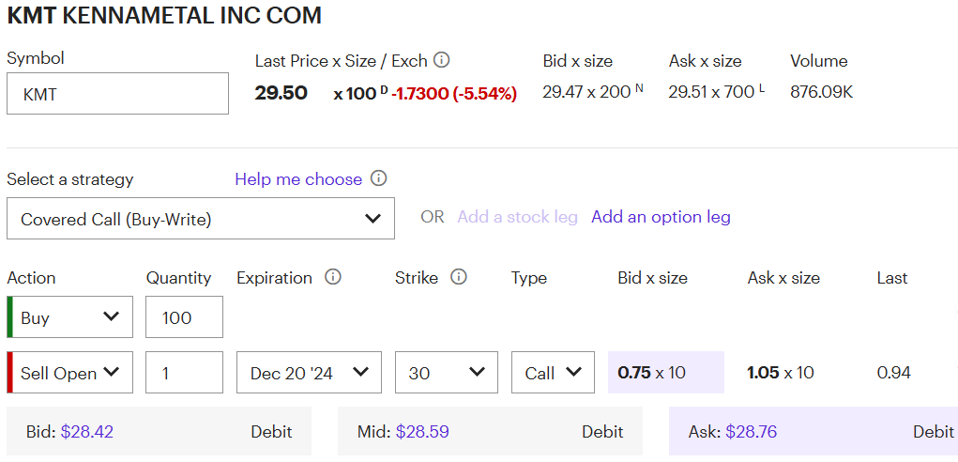

Kennametal (KMT) - Buy Write

Buy 100 KMT

Sell to Open 1 December 20 $30 Call

Execute for Net Debit of $28.60 or lower

Pittsburgh-based Kennametal (KMT) is a supplier of tooling, engineered components and materials consumed in production processes. Founded in 1938, the company provides materials science, tooling, and wear-resistant solutions to customers in aerospace, earthworks, energy, and general engineering and transportation.

We added Kennametal to the Forbes Billionaire small and midcap portfolio on October 28 at $25.59 per share. I was comforted by CEO Sanjay Chowbey purchasing $121,400 worth of company stock in June at $24.28 per share.

The CEO has plenty of company among billionaire investors who are buying Kennametal stock. Millennium Management, headed by quantitative investing expert Israel Englander, reported owning 154,000 shares as of June 28, and increased its stake by 57,000 shares in the second quarter. Clifford Asness’ AQR Capital Management reported a stake of 189,000 shares and added 51,000 shares to its position in the April-June period. Tudor Investment reported a stake of 270,000 shares at the end of June and inched up ownership by 19,000 shares in the second quarter. Among billionaire hedge fund managers, D.E. Shaw & Co. in its most recent 13F filing reported the largest stake in Kennametal at 482,000 shares.

On Wednesday, Kennametal reported fiscal fourth-quarter earnings that were below estimates, but the company’s bullish revision to full-year profit guidance helped shares to jump 19%.

Shares trade at $29.50, just below the $30 strike price, so we will write December 20 calls.

Here is the buy write: Buy 100 KMT, and sell to open one contract of $30 December 20 calls for a net debit of $28.60 (stock price minus premium) or lower. Try $28.55 at first.

If we earn the dividend and if KMT closes above $30 on December 20, we will be assigned and earn $1.60 per share on $28.60 per share at risk, or 5.59%. Over 43 days, that would be 47.5% on an annualized basis. If KMT closes below $30 at expiration, we will still own the stock at a cost basis of $37.60 per share, reflecting the premium earned today, and the dividend next week.

Options income for this trade: We earn $90 selling 1 December 20 $30 call contract.

NOTE: Forbes Premium Income Report is intended to provide information to interested parties. As we have no knowledge of individual circumstances, goals and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any assets or securities mentioned or recommended. We do not guarantee that investments mentioned in this newsletter will produce profits or that they will equal past performance. Although all content is derived from data believed to be reliable, accuracy cannot be guaranteed. John Dobosz and members of the staff of Forbes Premium Income Report may hold positions in some or all the assets/securities listed. Copyright 2024 by Forbes Media LLC.

Going Against The Grain With China Stock Buy Write For 98% Annualized Return Potential Next Two Weeks

You might think that shares of Chinese companies would be in major retreat after President-elect Donald Trump’s victory, but that is not the case. Even with the threat of major tariffs on Chinese goods coming into the United States, the iShares China Large-Cap (FXI) ETF today is up almost 5%. We will do a buy write that articulates a view that blue-chip Chinese stocks in the FXI will gain another 0.75% over the next two weeks.

Please email me (dobosz@gmail.com) at any time with questions, and connect with me on LinkedIn to keep in touch if our correspondence via this channel is interrupted. — J.D.

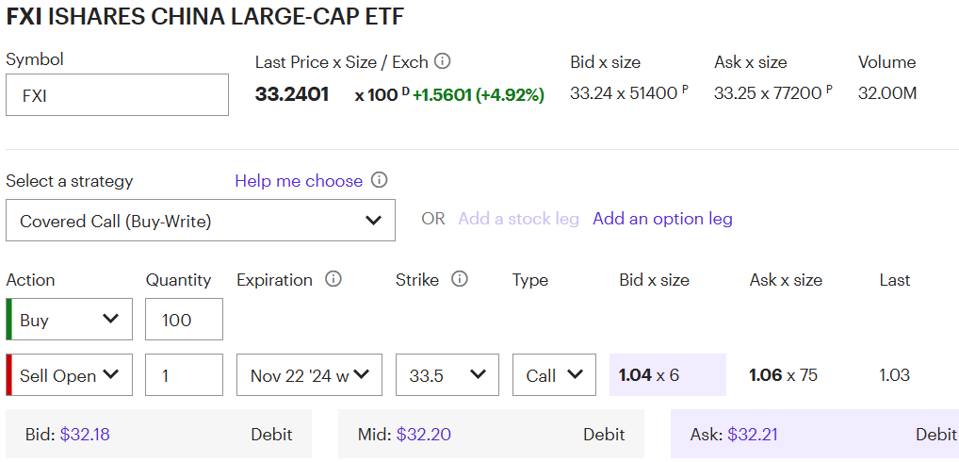

iShares China Large-Cap (FXI) - Buy Write

Buy 100 FXI

Sell to Open 1 November 22 (weekly) $33.50 Calls

Execute for Net Debit of $32.20 or lower

President-elect Trump has promised to slap major tariffs on Chinese goods, but the market is discounting the possibility that trade restrictions will hobble China’s economy or the value of companies operating there. This article from Hong Kong’s South China Morning Post lays out the case that China’s efforts to stimulate its economy, and the likelihood that negotiations will yield more favorable trade policies, will be beneficial for Chinese companies. During Trump’s first term, Chinese stocks nearly doubled.

The FXI is up almost 5% today and the ETF is still looking bullish on the charts.

Here is the recommended buy write: Buy 100 FXI and sell to open one contract $33.50 November 22 (weekly) calls. Execute the combined trade for a net debit of $32.20 or lower.

If FXI closes above $33.50 on November 22, we would earn $1.30 per share on $32.20 per share at risk, or 4.04%. Over a holding period of 15 days, this would be 98.2% on an annualized basis.

Options income for this trade: We earn $105 selling 1 FXI November 23 $33.50 call contract.