Magnet® Stocks- We are looking for the few on the tip of the Bell Curve, Jordan Kimmel, MagnetInvestment Insights

One of the most interesting and powerful facts of nature is that when measured against their counterparts, almost all things fall under a statistical bell curve. That means under the law of large numbers, ninety percent of measured items will fall into a range and are therefore essentially basically average, with five percent measuring far above the average and five percent far below the average. This is true for the height of trees, the height of human beings, scores on a round of golf, test scores in school, and, yes, basically in all things measurable. It should be obvious that if there was a quantifiable way to measure companies, we could identify the truly superlative ones.

Once you are free of simply trying to match or exceed benchmarks, you can go about identifying and investing the few individual companies that statistically come up as “outliers.” The best companies to invest in, the ones that have just entered their rapid growth period, are companies that are usually unfamiliar to the public. Even better, they are still below the radar of many professional managers at the large firms.

Often asset management companies will establish artificial barriers that prevent their own portfolio managers from investing in opportunities that are timely. Arbitrary rules are set up allowing for which companies the managers can invest in. Businesses that have been in operation for a minimum of ten years or do not trade with enough daily volume. These obstacles tend to lower returns. Magnet is open to more opportunities.

The unbiased quantitative methodology employed by our Magnet Stock Selection Process allows us to rank all publicly traded companies. Magnet ranks companies by cash flow, revenue growth, operating profit margin acceleration, and a host of other fundamental criteria and then combine this ranking system to establish a total Magnet® score. Several more levels of analysis are then required, but we are starting with elite companies.

Buying and holding the “wrong” stocks is a sure-fire ticket to the poor house. Taking small profits in companies that turn into major winners can feel equally frustrating. My answer to this dilemma is the “gardening approach” with your portfolio. This style suggests being patient and letting your winners grow, while periodically weeding out those ideas that simply are not developing.

Current Top Ten Magnet Stocks for Consideration:

(I have removed a few companies from this list that have had outsized returns since this newsletter began on July 15, 2024. They may be great companies, but the recent stunning returns do not suggest a good entry point today. Applovin is up more than 225% since July and 100% just last month. I also suggest you use stop losses. The July issue showed SuperMicro which is now down over 70%. Despite holding SMCI, the July portfolio has shown a return of 18% already. The portfolio we showed just last month returned over 21% as this note is being written. This is not sustainable.)

Top Magnet ideas for consideration:

Symbol Name

ADMA ADMA Biologics

ALL Allstate

BYRN Byrna Technologies

DY Dycom Industries

FOUR Shift4 Payments

FTI TechnipFMC

RSG Republic Services

TJX TJX Cos

VRTX Vertex Pharmaceuticals

WGS GeneDx Holdings

Be sure to pick-up a copy of Jordan Kimmel's books on Amazon

Please remember to sign-up for Jordan's weekly insights at ProInvestorInsights.Substack.com or MagnetInvestingInsights.com.

For further information: www.magnetinvestinginsights.com

The Trump Presidency: Economic Prospects and Concerns, Mish Schneider, MarketGauge

As Trump takes his position, he stands on a monumental political pedestal, one that few presidents before him have reached. Yet, as history has shown, the higher the rise, the steeper the potential fall. While there is optimism in some circles about what his administration might achieve, there are significant economic and policy concerns that suggest a challenging path forward.

Key Economic Concerns and Potential Challenges

1. Spending and National Debt

The escalating national debt and government spending remain critical concerns. Elon Musk has been a vocal advocate for reducing federal spending, but ultimately, Congress controls fiscal decisions. Reductions in Medicare, Social Security, or defense would be necessary to meaningfully cut costs—though such moves are highly unpopular and unlikely to gain traction. Realistically, the national debt may not see much reduction, nor is there likely to be a sharp decline in government spending. Musk’s vision is ambitious, but these needed changes are often politically untenable.

2. Tariffs, Taxes, and Inflation Risks

Balancing tariffs and tax cuts present another economic dilemma. While tariffs may bolster domestic industries, they could also drive-up labor costs if immigrant deportation policies reduce the workforce. Higher wages could lead to inflation. Other global and domestic factors contribute to inflation concerns, including:

A. China’s Economic Stimulus – China is likely to implement post-election economic measures, potentially affecting global inflation.

B. Middle East Conflicts – Escalations in Iran could disrupt energy supplies and add to inflationary pressures.

C. Climate and Food Prices – Unpredictable weather patterns may impact grain and sugar supplies, increasing food prices.

D. Growth and Regulation Policies – Trump’s pro-growth, anti-regulation stance is inherently inflationary, further complicating bond markets and interest rates.

E. Energy Transition – While traditional oil and gas remain essential, clean energy sources like solar, nuclear, and wind will be crucial. The energy landscape will need balance, and relying solely on fossil fuels is unsustainable.

3. Federal Reserve’s Role

The Federal Reserve’s stance on interest rates will be critical. A rate cut in December could drive up inflation while causing bond prices to surge. Liquefied Natural Gas (LNG) and aluminum prices are already trending higher, signaling inflationary pressures in certain commodities.

Should the Fed stay the course after the last rate cut, it sends a signal that there is inflation concern, which could be as damaging as seeing an actual rise in inflation.

Economic Strengths and Opportunities

Despite these concerns, there are positive economic indicators, particularly for small-cap stocks and certain sectors that stand to benefit from Trump’s policies:

1. Small Caps Leading the Market

Many investors view Trump’s policies as advantageous for small-cap companies, especially those focused on U.S. manufacturing and small business growth. The iShares Russell 2000 ETF (IWM) has outperformed other indexes, doubling their growth. IWM’s potential climb to its 2021 high at $244.50 and beyond reflects optimism in American manufacturing and growth-focused policies.

2. Retail and Consumer Sectors

Although retail (represented by the XRT ETF) has underperformed, a breakout above 80 could signal confidence in Trump’s deflationary policies, benefiting both small caps and retail. However, with interest rates high, consumer spending remains a vital component. Without consumer support, the market and broader economy may struggle to sustain momentum. This economic landscape differs sharply from the pre-Trump era of 2016.

3. Bitcoin and Digital Assets

Bitcoin has shown strength, maintaining a positive trajectory. However, it needs to hold above the $74,000 level to retain investor confidence and market strength. Our current target is close to around $90,000.

4. Seasonal Market Momentum

Historically, markets have rallied after elections, with seasonality offering a bullish factor that could encourage growth in the coming months.

Investment Recommendations

Given these market dynamics, several assets and sectors show promise for investors willing to navigate the complexities of today’s economy:

1. Gold and Silver

- Gold is a strong buy on dips, with robust support at $2,500.

- Silver, if it climbs back above $32.50, could also present a buying opportunity.

2. A Few Stock Picks in Key Sectors

Ulta Beauty (ULTA) Currently in a consolidation phase, the stock appears to offer a low-risk buying opportunity.

Alibaba (BABA) Trading within a support zone, potentially undervalued. Earnings on tap.

Stantec (STN) This environmental consulting firm could benefit from Musk’s pro-sustainability outlook.

Symbotic Inc An American robotics company specializing in warehouse automation, aligning with a trend towards industrial robotics.

XLE Energy ETF With global and domestic energy demands, this ETF could capture gains across energy sectors.

Trump’s presidency brings both optimism and caution. While some sectors stand to benefit, challenges like inflation, government spending, and global uncertainties pose risks. Investors should keep a close eye on interest rates, geopolitical developments, and inflationary pressures, balancing opportunities in small caps and energy with the potential for volatility. Strategic investments in certain commodities, and promising stocks across sectors could offer growth amid the complexities of this new economic era.

Watch Mish Schneider's appearance on WealthWise by clicking here:

Fed Rate Cut Predictions & Top Equity Picks: Jordan Kimmel with Mish Schneider

For further information, please visit MarketGauge.com

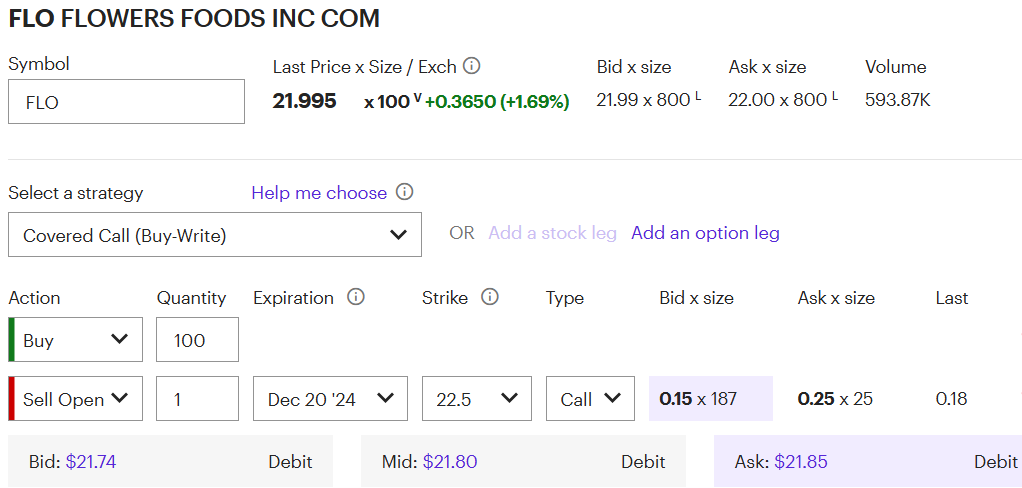

Dividend Baked Into Flowers Food Buy Write’s 47% Annualized Return Potential, John Dobosz, Forbes Magazine

Here is a buy write on shares of baked goods company Flowers Foods (FLO), which will trade ex-dividend within the next three weeks for a quarterly payout of at least $0.24 per share. The trade offers potential for a 43.7% annualized return through December 20. Although the recommendation is for buying 100 shares of stock and selling one contract of calls, you can scale it up as you see fit. Please email me (dobosz@gmail.com) at any time with questions, and connect with me on LinkedIn. — J.D.

Flowers Foods (FLO) - Buy Write

Buy 100 FLO

Sell to Open 1 December 20 $22.50 Call

Execute for Net Debit of $21.80 or lower

Originating in 1919 as a small southern bread-baking operation, Thomasville, Ga.-based Flowers Foods (FLO) is one of the largest bakeries in the United States, selling bread and snacks in grocery stores, convenience stores and in vending machines. Its best-known brands are Wonder white bread and the Nature's Own brand of more nutrient-rich breads.

Flowers has made more than 100 acquisitions in its 125-year history to tap into changing consumer tastes. Two of its top-performing and well-known buys are snack cake and donut makers Mrs. Freshley’s and Tastykake. Flowers’ acquisitions of Dave’s Killer Bread and Canyon Bakehouse make Flowers the largest organic bread company in the U.S. It has seen rapid growth in recent quarters from Dave’s Killer Bread product extensions in snack and nutrition bars.

Revenue this year is expected to grow 1% to $5.12 billion, with earnings higher by 5.7% to $1.27 per share. The next earnings report is not until February.

At 17.3 times year-ahead earnings, Flowers trades at a 15% discount to its five-year average P/E ratio. Along with the discounted valuation, Flowers feeds nice dividends, currently good for a yield just above 4.4%. The next dividend is still undeclared, but the last payout was $0.24 per share, and the fourth quarter ex-dividend date has historically been the final week of November or the first week of December.

We hold Flowers Foods in the Forbes Billionaire small and midcap portfolio, as several billionaires have been buyers of the stock over the past year, including Ken Fisher, Ken Griffin, Steven Cohen and Mario Gabelli.

Here is the buy write: Buy 100 FLO, and sell to open one contract of $22.50 December 20 calls for a net debit of $21.80 (stock price minus premium) or lower.

If we earn a $0.24 per share dividend, and if FLO closes above $22.50 on December 20, we will be assigned and earn a total of $0.94 per share on $21.80 per share at risk, or 4.31%. Over 36 days, that would be 43.7% on an annualized basis. If FLO closes below $22.50 at expiration, we will still own the stock at a cost basis of $21.56 per share, reflecting the premium earned today, and the dividend in a few weeks.

Bagging Premium And Dividend With Tapestry Buy Write

Companies that produce and sell luxury goods have been given a warm market reception following the election. Unlike dollar stores who will likely see reduced demand in the face of higher U.S. tariffs on imported goods, luxury shoppers are less price sensitive and more insulated from higher impor costs. In addition, luxury brands have stores in Europe, Asia and elsewhere outside the U.S. will that will not be hit with tariffs.

One of these brands is handbag and accessories maker Tapestry (TPR). With an upcoming dividend in three weeks, we will do a buy write. Please email me (dobosz@gmail.com) anytime with questions. — J.D

Tapestry (TPR) - Buy Write

Buy 100 TPR

Sell to Open 1 December 27 (weekly) $58 Call

Execute for Net Debit of $55.90 or lower

New York, N.Y.-based Tapestry (TPR) is a maker and retailer of luxury accessories and lifestyle brands, including handbag specialists Coach and Kate Spade, and Stuart Weitzmanan shoes. It sells through company-operated stores, department stores, internet, and independent distributors.

Revenue this year is expected to rise 1.4% to $6.8 billion, with earnings up 6.3% to $4.56 per share. Tapestry trades for 12.7 times year-ahead earnings.

Tapestry’s next earnings report is not until February, and the stock trades ex-dividend on December 6 for a $0.35 per share quarterly payout.

Here is the recommended buy write: Buy 100 TPR, and sell to open one contract of $58 December 27 (weekly) calls. Use a net debit of $55.90 or lower.

If we earn the dividend on December 6, and if Tapestry closes above $58 at expiration, we would be assigned and earn $2.45 per share on $55.90 at risk for a total return of 4.38%. Over a 43-day holding period, the annualized return would be 37.2%. If TPR closes at or below $58 on December 27, we will still own the stock at a cost basis of $55.55 per share, reflecting the premium earned today and the dividend on December 6.

Options income for this trade: We earn $195 selling 1 TPR December 27 (weekly) $58 call contract.

NOTE: Forbes Premium Income Report is intended to provide information to interested parties. As we have no knowledge of individual circumstances, goals and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any assets or securities mentioned or recommended. We do not guarantee that investments mentioned in this newsletter will produce profits or that they will equal past performance. Although all content is derived from data believed to be reliable, accuracy cannot be guaranteed. John Dobosz and members of the staff of Forbes Premium Income Report may hold positions in some or all the assets/securities listed. Copyright 2024 by Forbes Media LLC.

For further information: John Dobosz (forbes.com)

Click here to connect with John Dobosz on LinkedIn: https://www.linkedin.com/in/johndobosz/

We Got the Decisive Election the Market Craved, Jason Bodner, Navellier & Associates

It’s finally over.

On the one hand, I am obviously talking about the election – it was hotly debated down to the wire, but like him or hate him, Trump won decisively. George Washington won every vote. We’ll never have another president voted in unanimously. That honor is now retired, going to our first president alone.

On the other (a bit less obvious) hand, I am talking about the end of uncertainty. A decisive election allows everyone to move on, if they can. I’m not into politics; I’m into data and investing. As an investor, all one hopes for is a decisive election. That’s what we got, and the market loved it.

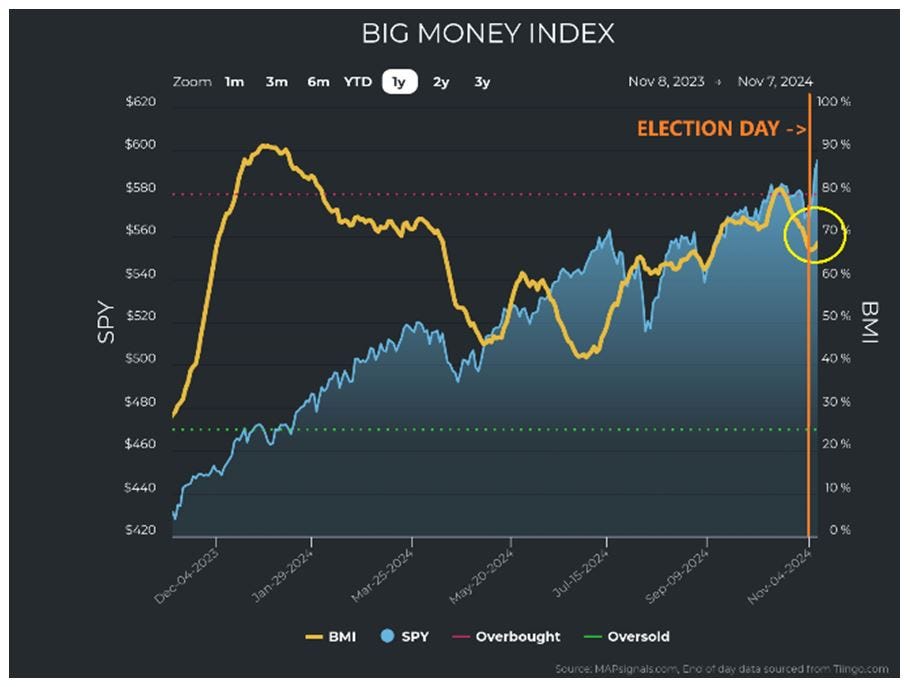

The Big Money Index (BMI) is still the best metric for revealing unusually large money flows in the stock market. In October, the BMI became overbought then dropped out of being overbought after only four days. As the election tightened, investors sidestepped risk, moving money out of stocks. Then, after election day (the orange vertical line), money gushed back into stocks: